1. Introduction

What are withholdings??

Withholdings on account of Personal Income Tax are advances to the Treasury, amounts of money advanced to the Tax Agency on account of the expected result in the income tax or corporate income tax return.

They are regulated by law, which establishes the percentages to be applied in each case. They are obligatory and affect many types of income, among which are those of employees, professionals and the rental of premises or offices.

2. Set up

For the correct functioning of the IRPF product development it is necessary to make a series of previous configurations:

a. Withholding report grouping codes

The report grouping codes specify the report associated to the payment key that will affect the withholding. They are used to show the withholdings applied to clients/suppliers grouped by different concepts.

It could be applied as codification of the different models requested by the Internal Revenue Service (models 100-199), but it must be taken into account that Business Central does not generate any of these models and that the user should fill in the data requested by the Internal Revenue Service manually.

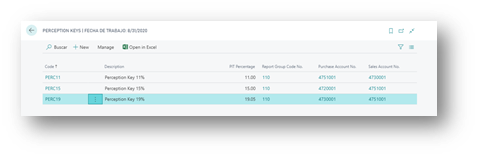

b. Perception key

The payee keys specify the withholding percentage to be applied, the associated report grouping code and the purchase and sales accounting accounts to which the withholding amount is to be applied.

The Collection Keys contain this following information:

- Code: a mandatory data which can be freely defined; it does not have to include the retention percentage to be applied and it is used to identify the perception key.

- Description: this field gives more information, but it is not mandatory.

- Allow Zero Percentage: this mark indicates that a withholding will be made as such, but the amount of this will be 0. If this check is checked, the “PIT Percentage” field is set to 0 and disabled. If you want to make a retention with amount 0 this check must be marked, it is not worth putting the retention percentage to 0. If this field is not checked and the retention percentage is 0 when registering the invoice gives an error.

- Withholding %: a mandatory data that indicates the retention percentage to be applied with that perception key.

- Grouping Code – PIT Report: used to show withholdings applied to customers/suppliers grouped by different concepts. Mandatory.

- Purchase Account No.: Account number, from Chart of Accounts, where to post amounts coming from purchase documents.

- Sales Account No.: Account number, from Chart of Accounts, where to post amounts coming from sales documents.

These Purchase and Sale accounts must be set up with a “VAT posting group” that does not force to generate VAT entries. For a proper set up, “VAT Buss. Posting Group” with “VAT Item Posting Group” card needs to be set up also with a “Calculation = No VAT” and “VAT Percentage = 0”.

These perception Keys are detailed at the level of the customer/vendor card for all your documents to consider at the time of being registered.

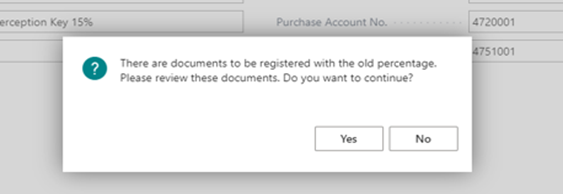

In case a user modifies the withholding percentage in a Collection Key, Business Central will revise all non-posted purchase/sale invoices/credit memos to determine if a retention line has been added in the document. If so, Business Central will show a message like this one to advertise the user to update (or not) these lines in those documents:

If user tries to change the purchasing/sales account or the grouping code – pit report on withholding key, Business Central will check that there are no unapplied entries; if so, it will display the following message:

In case of an affirmative answer, the user must adapt manually the PIT accounting information. It is highly recommended not to change this value. Please define a correct set up from the beginning.

If the user needs to delete a Collection Key, Business Central will check all these scenarios:

- There are no suppliers/customers set up with that collection key

- There are no purchase/sales invoices/credit memos open and with a retention line generated with that collection key

- There are no unapplied entries with that collection key

In case of an affirmative answer, the user will be allowed to delete the record.

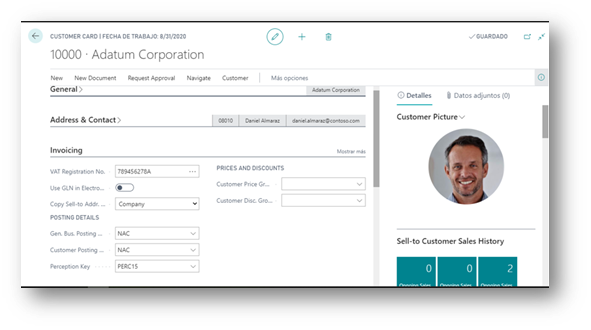

c. Customer

Within the Customer Card is a field, called “Perception Key”, on the Billing tab in which you must set up the perception key associated with that customer.

d. Vendor

Within the Vendor Card is a field, called Perception Key on the Billing tab, in which you must set up the collection key associated with that vendor.

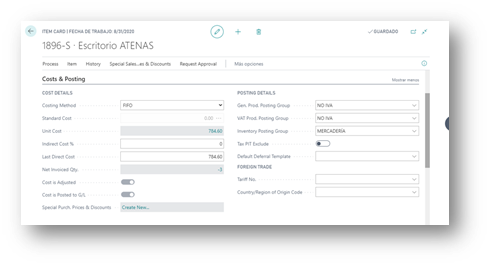

e. Product

By default, the IRPF calculation will be applied to all the products included in the documents (invoices and credit memos) of customers/suppliers that have a detailed payment key in their file. To omit certain products, the field Exclude from withholding taxes included in the product file, tab Costs and registration must be activated.

In invoices and credit memos, the amount corresponding to the product line that has this field activated will not be part of the IRPF base.

f. G/L Account

By default, the IRPF calculation will be applied to all the accounting accounts included in the documents (invoices and credit memos) of customers/suppliers that have a detailed Payment Key in their file. To omit certain accounting accounts, the field Exclude from withholding taxes included in the accounting account tab, Registration tab, must be activated.

In invoices and credit memos, the amount corresponding to the line of the accounting account that has this field activated will not be part of the income tax base.

3. Purchasing withholdings

Withholding taxes will be calculated within credit memos and purchase invoices if the supplier has been configured with a payment key and if the account and/or product does not have the field Exclude from withholding taxes checked.

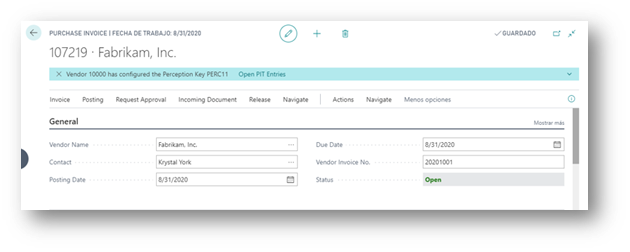

When selecting a supplier that has configured a withholding key, an informative message will appear at the top of the screen informing about the assigned withholding key. In addition, there is the possibility of visualizing all its registered withholdings by clicking on Open withholding movements.

When you launch the purchase invoice or credit memo, the following message is displayed to alert the user about the automatic PIT calculation:

Purchase document amounts will be refreshed the next time you open the document or pressing F5 (Refresh) after the calculation.

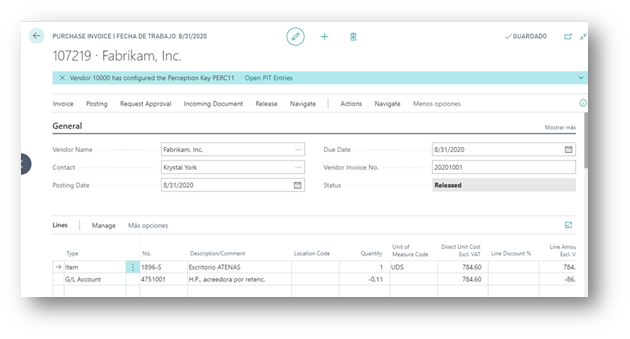

The automatically inserted PIT line holds the following information:

- Type: G/L Account

- Purchase g/l account set up in the Collection Key associated to the vendor

- Description: G/L Account name set up in Chart of Accounts

- Quantity: PIT percentage set up in the Collection Key associated to the vendor, divided by -100

- Direct Unit Cost Excluded VAT: the sum of all the amounts in “Line Amount Excluded VAT” from all the document lines with no “Exluded from PIT” activated.

- Line Amount Excluded VAT: the result of multiplying Quantity per Direct Unit Cost Excluded VAT

If the perception key associated with the vendor has the check marked “Allow Zero Percentage” the line will be created in the same way, but with an amount of 0.

When posting this document, system will create a new unapplied withholding entry

On this posted document you will see new information according to PIT:

- Exclude from PIT: states if this line is considered or not on PIT calculation

- Withholding Line: define this line as retention line

- Withholding base amount: Amount on which the withholding tax rate will be applied

- PIT %: percentage to be applied on the base of withholding tax to obtain the withholding amount.

These default fields are not displayed on the unposted invoice/credit pages, but can be added by the user.

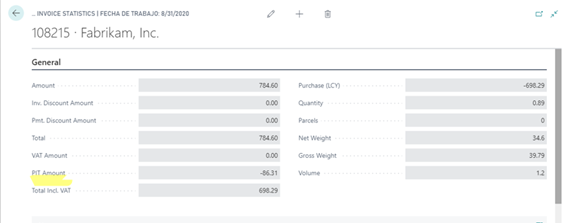

A new field called PIT Amount is displayed on the statistics screen for posted and unregistered invoices/credits that is calculated by multiplying the withholding tax base by % withholding tax, divided by 100 and negative (because that is what should be paid to the Tax Agency).

On the Navigate option for invoices and credit memos, you can view the withholding entries that are generated with that document:

Clicking on the ledger numbers field we can access the withholding entries screen to display the withholding entries generated with this posted invoice/credit memo:

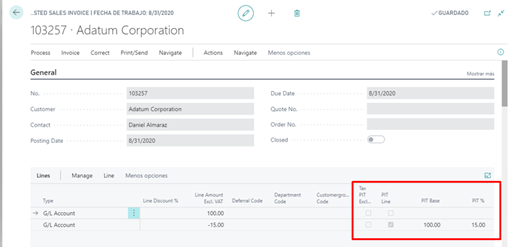

4. Sales withholdings

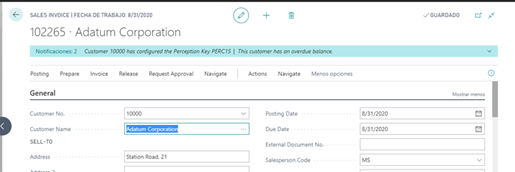

Sales withholdings work the same as withholdings on purchases for credit memos and sales invoices:

Withholdings will be calculated within credit memos and sales invoices if the customer has been set up with a perception key and if the account and/or product does not have the Tax PIT Exclude field marked.

Selecting a client that has a perception key configured an informational message will displayed at the top of the page informing about the perception key assigned to it. In addition, you can view all your posted withholdings by clicking Open withholdings entries.

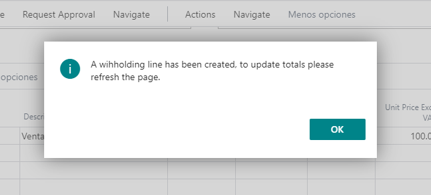

When you release the invoice or credit memo, the following message is displayed to alert the user of the automatic calculation of PIT:

For the value of the invoice or credit memo totals to be recalculated correctly, you must refresh the page (F5) or exit and re-enter the document

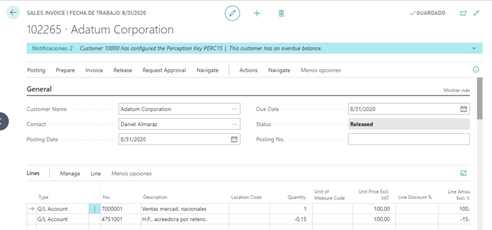

The automatically inserted retention line contains the following information:

- Type: G/L Account

- Sales G/L account set up in the Collection Key associated to the customer

- Description: G/L Account name set up in Chart of Accounts

- Quantity: PIT percentage set up in the Collection Key associated to the customer, divided by -100

- Direct Unit Cost Excluded VAT: the sum of all the amounts in “Line Amount Excluded VAT” from all the document lines with no “Exluded from PIT” activated.

- Line Amount Excluded VAT: the result of multiplying Quantity per Direct Unit Cost Excluded VAT.

As in purchases, if the perception key associated with the customer has the check marked “Allow Zero Percentage” the line will be created in the same way, but with an amount of 0.

When posting the invoice or credit memo, an open withholding tax entry of type sales is generated:

New information appears on the retention line on the posted invoice or credit memo:

- Exclude from PIT: states if this line is considered or not on PIT calculation

- Withholding Line: define this line as retention line

- Withholding base amount: Amount on which the withholding tax rate will be applied

- PIT %: percentage to be applied on the base amount of withholding tax to obtain the withholding amount.

These default fields are not displayed on the unposted invoice/credit memo screens but can be added by the user.

A new field called PIT Amount is displayed on the statistics screen for posted and unregistered invoices/credits memo that is calculated by multiplying the withholding tax base by withholding tax %, divided by 100 and negative (because that is what should be paid to the Tax Agency).

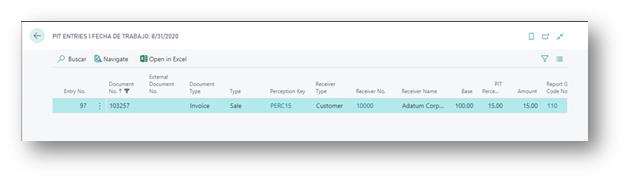

On the Navigate option for invoices and credit memos, you can view the withholding entries that are generated with that document:

Clicking on the ledger numbers field we can access the withholding entries screen to display the withholding entries generated with this posted invoice/credit memo:

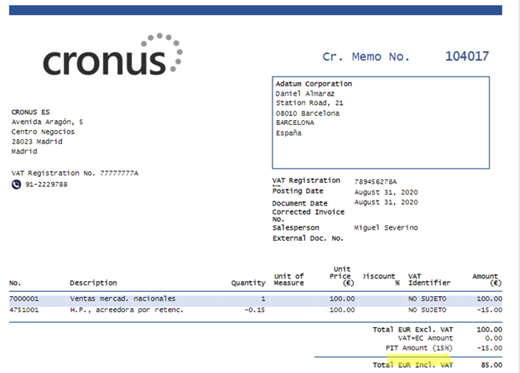

a. Documents

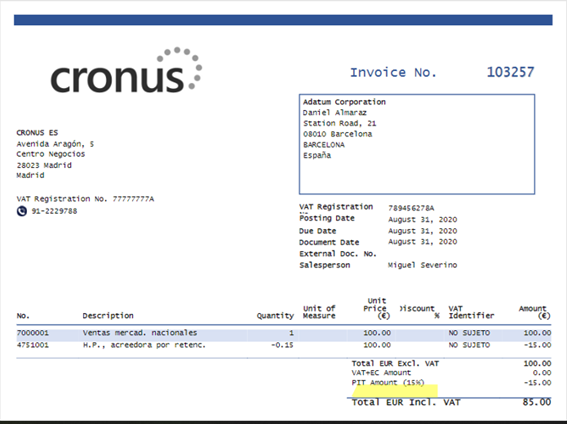

In the printing of sales documents (credit memo and invoice) a line has been included in the totals section to detail the amount and retention percentage that affects that document:

I. Sales credit memo

II. Sales invoice

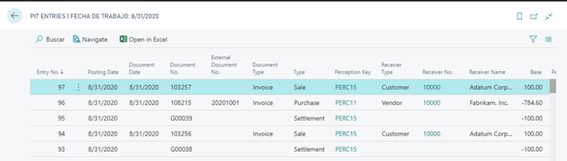

5. Withholding entries

Withholding entries are generated from the posting sales / purchase invoices or credit memos. The withholding tax entry will be open until the withholding tax is payed.

This screen contains the following information:

- Entry No.: This is an autogenerated number that will help you know which entry you are settling and which entries you settle.

- Posting Date, Document Date, External Document No.: values from posted invoices/credit memo that generated the withholding entry

- Document No.: If the document type is credit memo/invoice and is a sales/purchase operation the Document No. will come from those posted documents, but if the line belongs to a settlement type entry, this Document No. is the one indicated on the withholding payment screen in the Document No. field.

- Document type: invoice or credit memo

- Type: Purchase, sales or settle

- Perception key: is the perception key associated with the posted credit memo/invoice.

- Preceptor type: customer or vendor.

- Preceptor No., Preceptor Name, VAT Registration No.: data from customer or vendor associated to the invoice/credit memo

- Base: Withholding base, is the amount on which the retention percentage will be applied. It is negative if it is purchase invoice or sales credit memo and positive if it is sales invoice or purchase credit memo.

- Retention percentage: This is the percentage that will be applied on the base of retention.

- Amount – Withholding amount, calculated by multiplying the withholding tax base by the withholding tax percentage, divided by 100.

- Report grouping code: Used to display retentions applied to customers/vendors grouped by different concepts.

- Withholding account – The purchasing or sales ledger account set up in the perception key and where the note was generated at the time of posting the documents.

- Closed – Shows if the withholding tax entry is closed by a settlement entry.

- Closed by entry number: Indicates the settlement entry number that closes this withholding tax entry. If No. is 0 means that the entry is not yet closed and the Closed field must not be checked.

Cerrado por nº de mov.: indica el nº de movimiento de liquidación que cierra este movimiento de retención. Si el Nº es 0 significa que el movimiento aún no está cerrado y el campo Cerrado no debe estar marcado.

6. Withholdings payments

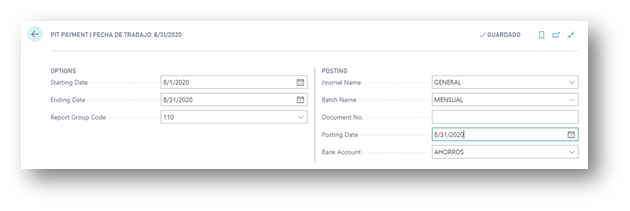

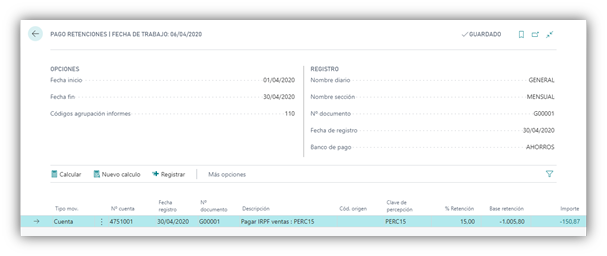

Withholding tax payment is the process that generates a withholding tax entry of type settlement and closes the entries that fall within the parameters indicated on the Withholding payment screen:

This screen contains the following information divided into two sections:

- Options: These are the filters with which to retrieve information from the withholding entry table.

- Starting date

- Ending date

- Grouping codes

- Posting – Displays the data where the settlement entries are to be posted.

- Journal name

Journal Batch: The journal batch must not have the Copy VAT Setup to Jnl. Lines marked

- Document No.: If we do not enter a document No. when calculating it generates one automatically that comes from the journal serial number. This document number is the identification number of the settlement document and appears on the withholding tax entries screen on the settlement type line.

- Posting Date

- Payment Bank

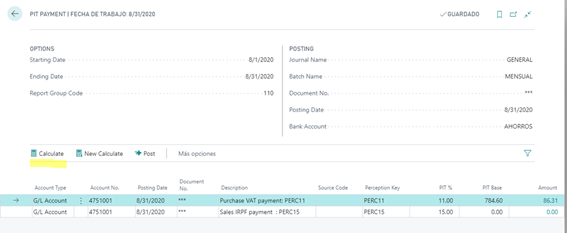

When you fill in the Payment Withholdings screen you can see a few buttons under the Options and Registration sections:

When you click the Calculate button, the outstanding withholdings entries are displayed according to the section indicated in Options and grouped by Perception Account and Perception Key:

The Description field is suggested, but it can be edited.

In the Amount field, you can see the withholding entries that would be closed with that settlement line. The value in the Amount field is the sum of the amounts of those outstanding withholding entries:

As long as the line has not been posted you can press the New Calculate button, this button is used to clear the filters in the Options section and allow to modify the data in the Registration section to recalculate new withholding lines.

After calculating a new button appears, Post. When you click the Post button, a new settlement line appears in the withholding tax entries that causes the corresponding withholding entries to close and the Closed field to be marked and the Closed by Entry No. field is filled in with the settlement entry no. Once posted you cannot go back.

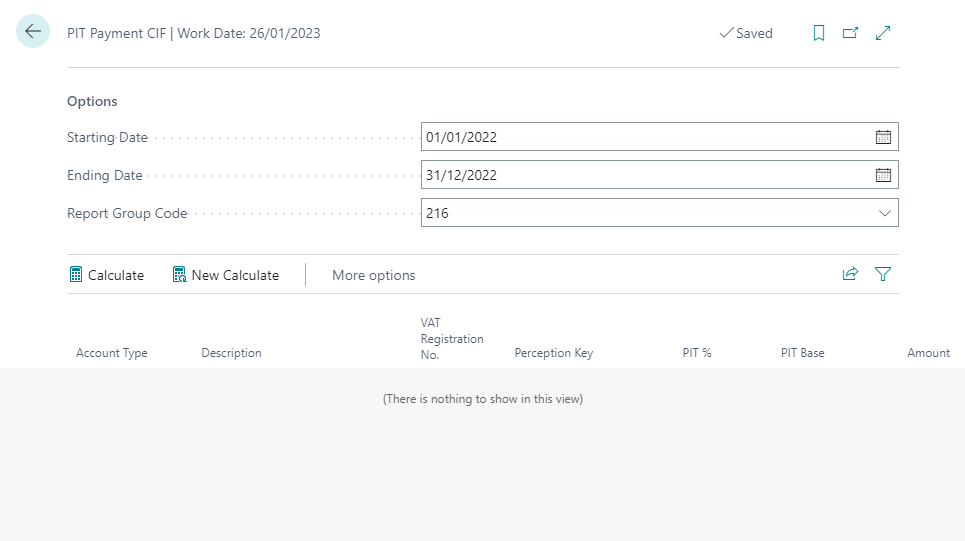

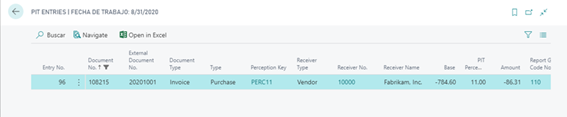

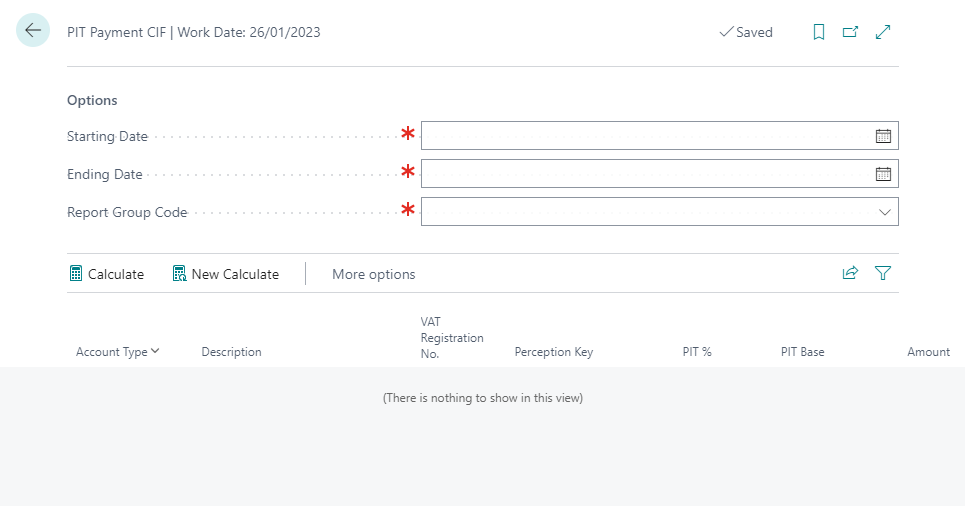

7. Query of withholdings by CIF

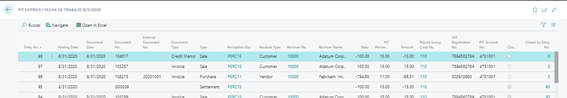

It is a query of the withholding movements grouped by CIF and by payment key.

To do this, we must indicate between which dates we want to retrieve this data and on which grouping code. We can “Calculate”, create a new query leaving all fields blank “New calculation” or export to Excel the contents of the table we are viewing “Open in Excel”